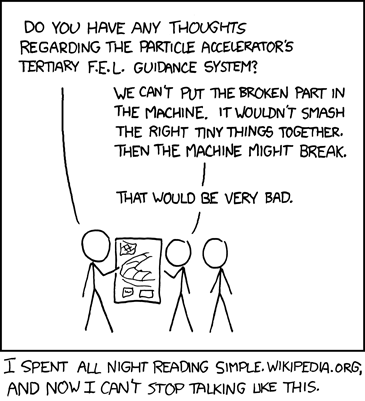

Simple English Wikipedia is an edition of the open-source encyclopedia designed to be intelligible to small children, adults with learning disabilities, and people who are learning English. It is also an entertaining read, because the simple language often makes things silly. I found the article on Keynesian economics to be particularly silly and entertaining:

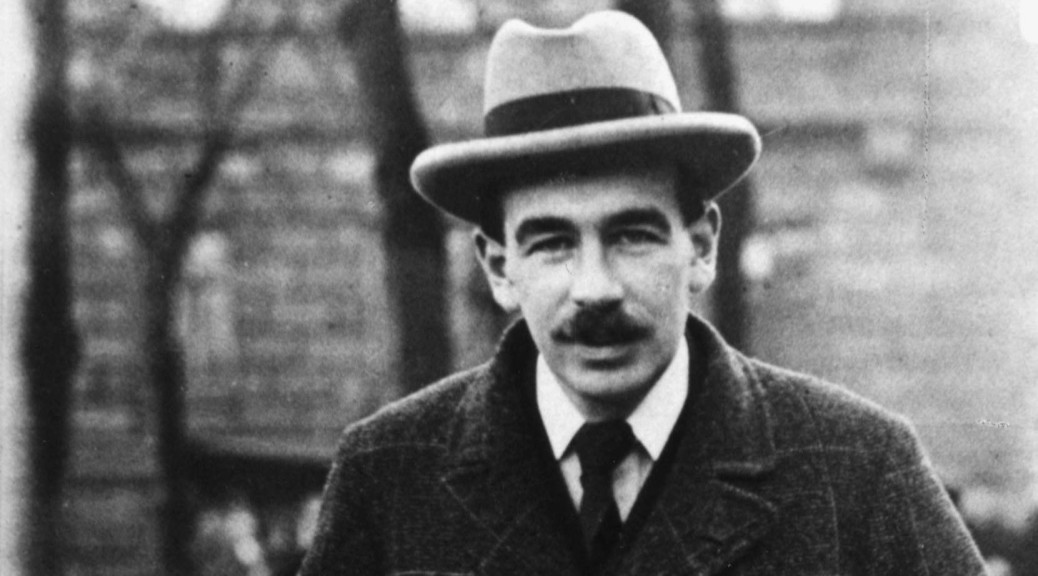

Keynesian economics (also called Keynesianism) describes the economics theories of John Maynard Keynes. Keynes wrote about his theories in his book The General Theory of Employment, Interest and Money. The book was published in 1936.

Keynes said capitalism was a good economic system. In a capitalism system, people earn money from their work. Businesses employ and pay people to work. Then people can spend their money on things they want. Other people work and make things to buy. Sometimes the capitalism system has problems. People lose their work. Businesses close. People cannot work and cannot spend money. Keynes said the government should step in and help people who do not have work.

This idea is called “demand-side policy”. If people are working, the economy is good. If people are not working, the economy is bad.

Keynes said when the economy is bad, people want to save their money. That is, they do not spend their money on things they want. As a result there is less economic activity.

Keynes said the government should spend more money when people do not have work. The government can borrow money and give people jobs (work). Then people can spend money again and buy things. This helps other people find work.

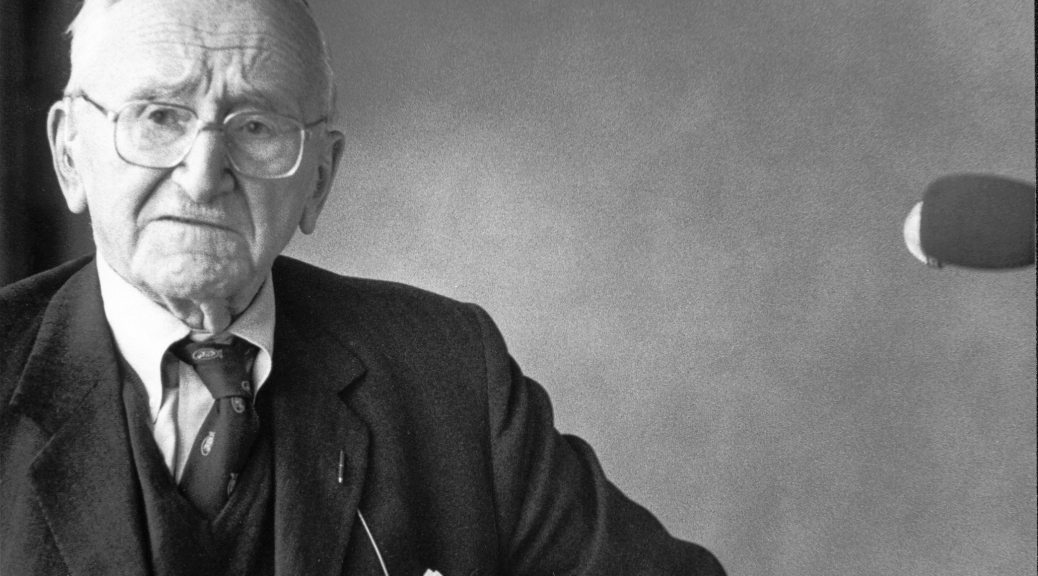

Some people, such as conservatives, libertarians, and people who believe in Austrian economics, do not like Keynes’ ideas. They say government work does not help capitalism. They say when the government borrows money, it takes money away from businesses. They do not like Keynesian economics because they say the economy can get better without government help.

During the late 1970s Keynesian economics became less popular because inflation was high.

When a big recession happened in 2007, Keynesian economics became more popular. Leaders around the world (including Barack Obama) created stimulus packages which would allow their government to spend a lot of money to create jobs.

Hilarious!