Today’s guest on Economics Detective Radio is Nolan Gray. Nolan is a writer for Market Urbanism and the host of the recently launched Market Urbanism Podcast.

Market urbanism is the synthesis of classical liberal economics and an appreciation for urban life. Market urbanists are interested in economic issues specific to cities, such as housing affordability and urban transportation.

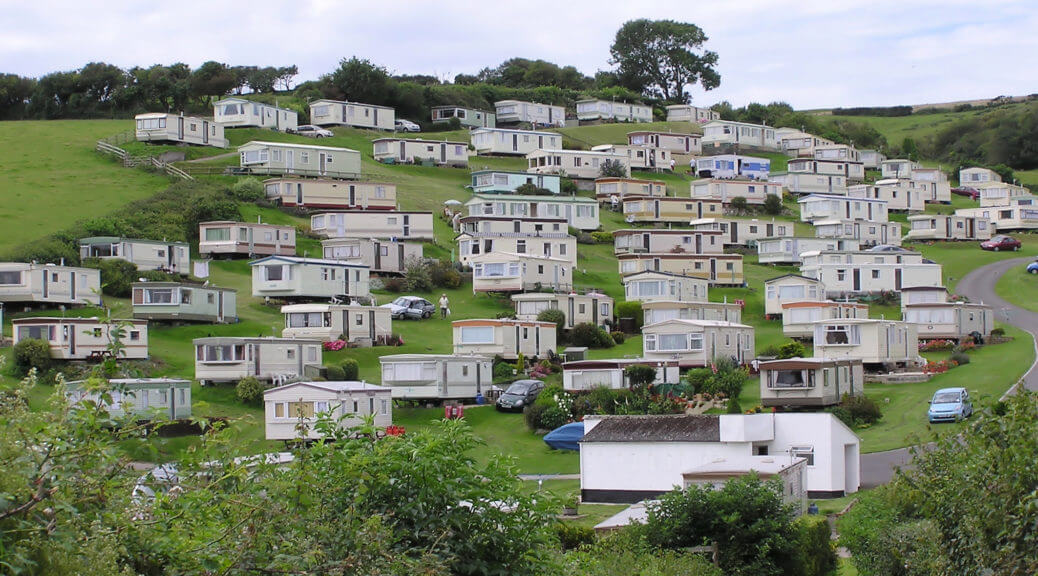

Nolan wrote an article titled “Reclaiming ‘Redneck’ Urbanism: What Urban Planners Can Learn From Trailer Parks.” As Nolan points out, trailer parks are remarkable in that they achieve very high densities with just one- and two-story construction. They do so while providing remarkably low rents of between $300 and $500, or $700 to $1,100 per month to live in brand new manufactured homes. They are also interesting in that the park managers provide a form of private governance to their tenants.

A century ago, there were many kinds of low-income housing available to people of lesser means. Low-quality apartments, denser housing, and boarding houses have largely been regulated out of existence. The remarkable thing about trailer parks is that they haven’t been made illegal or untenable by regulation. The one thing trailer parks don’t have is a mixture of uses, but they get around this by locating close to business areas.

Cities in Europe and Japan, which didn’t adopt American-style zoning, have much higher density and more mixed-use neighbourhoods. Houston, which has taken steps to deregulate, has seen more development of this sort recently. It seems like dense, mixed-use neighbourhoods pass the market test whenever they are allowed.

Sonia Hirt, in her book Zoned in the USA, explains why city planners became focused on separating uses. When these rules were first being adopted, industry polluted much more than it does today, so there was a health justification for separating them. But there were also superstitions, such as the idea that having children close to groceries would spread disease.

William Fischel’s homevoter hypothesis states that local homeowners engage in political activism to prevent development, thus protecting their home prices. They may justify their opposition to development in terms of environmentalism or preserving local character, but homeowners stand to gain or lose a significant portion of their life savings depending on the price of their homes. This makes local politics particularly hostile to new development and denser, more affordable housing.

Meanwhile, people blame everything except land use restrictions for high housing prices. Foreign buyers have been a recent scapegoat in Vancouver, which adopted a tax on foreign buyers, thus popping its housing bubble. Airbnb is also blamed for high housing costs, though its effect is certainly negligible.

While housing is important because it is many households’ largest expense, inelastic housing supplies prevent people from moving for labour opportunities. Autor, Dorn, and Hanson (2016) show how many local labour markets in America never really recovered from a trade shock with China in the early 2000’s. Much of this may have been due to America’s inelastic housing supply. When industries like the furniture industry were outcompeted by Chinese imports, the people who owned homes in furniture-producing towns lost both their jobs and the value of their homes. With home prices elsewhere being so high, many of these people chose to spend the rest of their lives on welfare rather than moving to find work. Ed Glaeser has written more on the costs of subsidizing home ownership.

Home ownership is a bad investment. Having a single, large asset take up a large part of one’s portfolio is just bad investing, particularly when that asset’s value is correlated with your labour earnings. While one can hedge one’s home value against futures markets based on the Case-Shiller index, but few people do this.

Errata: I accidentally referred to The Simpsons character Frank Grimes as Rick Grimes. Rick Grimes is from The Walking Dead. Also, I wrongly said that the paper on the China shock was by Angus Deaton. Somehow I mixed him up with David Autor. Same initials, just reversed?

Other Links:

Jane Jacobs as Spontaneous Order Theorist with Pierre Desrochers

The California exodus to Texas is reflected in market-based, one-way U-Haul truck rental prices

Subscribe to Economics Detective Radio on iTunes, Android, or Stitcher.